Japanese mining firm SBI Crypto has reported suspicious outflows worth roughly $21 million across multiple cryptocurrencies, with blockchain analysts noting patterns that resemble past hacks attributed to North Korea’s Lazarus Group.

Key points:

- Hackers stole $21 million from SBI Crypto, draining wallets containing Bitcoin, Ethereum, Litecoin, Dogecoin, and Bitcoin Cash before laundering the funds through instant exchanges and Tornado Cash.

- Analysts suspect involvement of the Lazarus Group as on-chain patterns mirror past North Korean state-backed cyberattacks.

- SBI Crypto has remained silent on the incident, drawing criticism as industry leaders including Binance’s Changpeng Zhao highlight the need for fast communication and response.

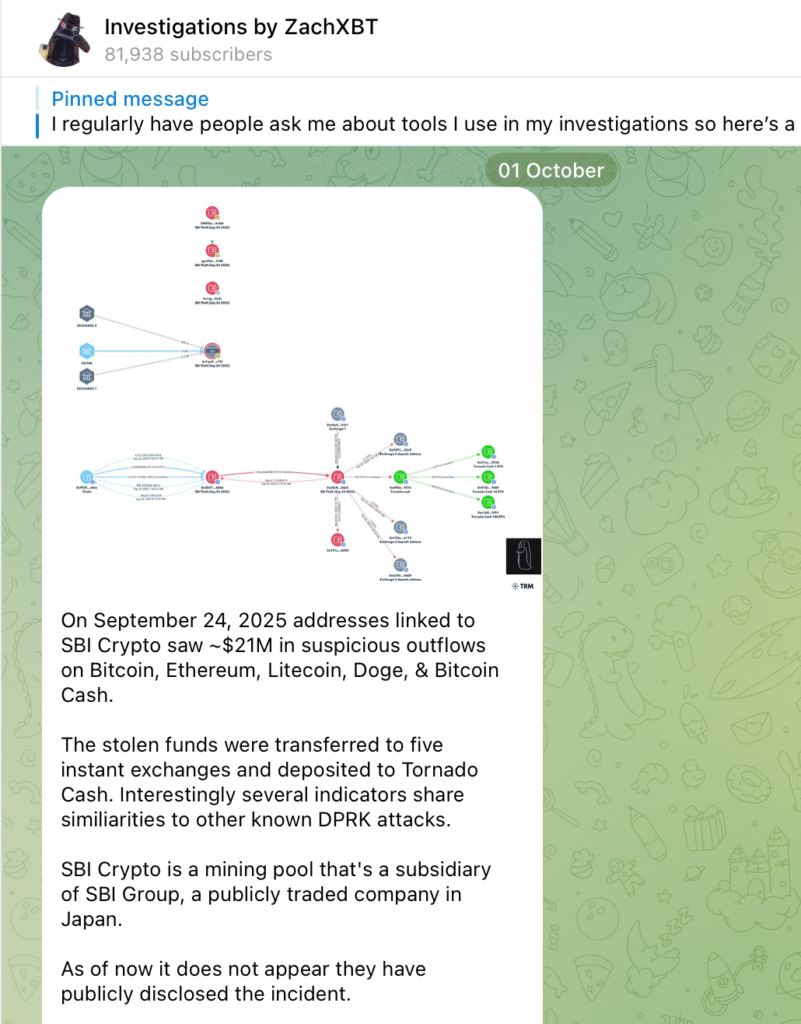

On-chain investigator ZachXBT reported that wallets tied to SBI Crypto recorded unusual outflows involving Bitcoin, Ethereum, Litecoin, Dogecoin, and Bitcoin Cash. The stolen funds were funneled through five instant exchanges before being routed into Tornado Cash, a non-custodial cryptocurrency mixing service designed to obscure transaction trails.

Blockchain data reveals that the compromised wallets, including those beginning with “0x40d7” and “bc1qx0a2k”, were drained in a coordinated manner and routed through laundering mechanisms.

Furthermore, ZachXBT observed that the methods employed in the SBI Crypto breach bore striking similarities to previous operations attributed to North Korea’s state-backed Lazarus Group, a cyber unit long linked to high-profile crypto thefts.

Related: Crypto Titans Bunker Down Now: Vitalik’s Austerity Vow, Binance $1B Bitcoin Shield

SBI Crypto has not yet issued a public statement regarding the incident, a silence that has sparked considerable discussion across online communities. Responding to a post on X by user Crypto Jargon about the breach, Binance co-founder and former CEO Changpeng Zhao emphasized that in cases like this, “fast communication and response” are critical.

“Speed is everything in these situations. With SBI not even disclosing yet, the silence could be as damaging as the hack itself. When billions in user trust are on the line, slow comms = bigger losses,” Crypto Jargon posted in response to Zhao.

Related: Crypto Industry Now Mobilizes Against Perceived Quantum Threat

The laundering of funds through Tornado Cash has once again put the controversial crypto mixer under the spotlight. Sanctioned by the U.S. Treasury in 2022, Tornado Cash was accused of facilitating illicit transactions, including those tied to North Korean-linked operations.

The SBI Crypto incident emphasizes the growing sophistication of digital heists and the mounting challenges faced by exchanges, regulators, and investigators in tracing stolen funds. As cybercriminals continue to refine their laundering methods, industry observers stress the importance of collaboration across platforms and jurisdictions to curb such activity.

The case also spotlights the vulnerability of even well-established firms to advanced tactics, adding fresh urgency to the debate over security standards in the crypto sector.