Shiba Inu (SHIB) is defending its New Year gains as the market enters a period of post-rally digestion. Tradеrs are watching closely to see if the recent 30% move marks a fundamental trend transition.

Key Points

- Shiba Inu is consolidating near $0.00000948 following a 30% weekly bounce, signaling healthy post-rally stabilization.

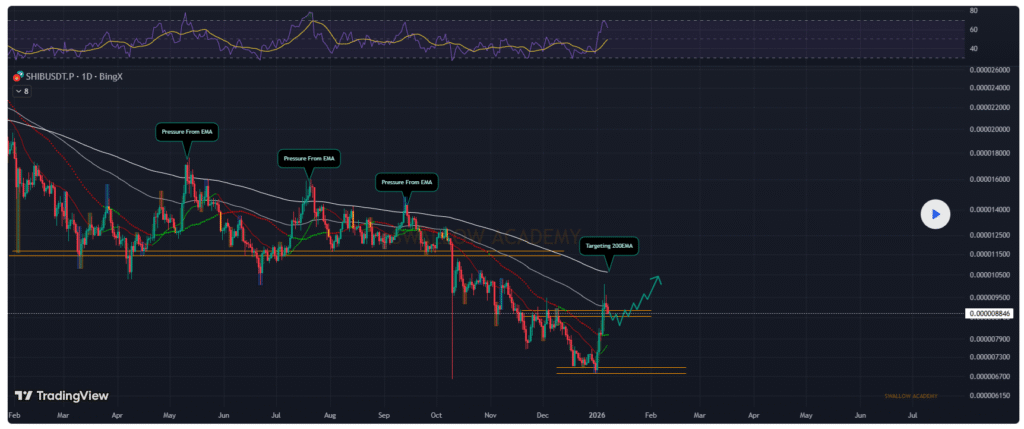

- Short-term moving averages (10, 20, 50) have turned bullish, but the price remains below the critical 200-day EMA.

- Analysts view the low Fear & Greed Index (28) as evidence of professional accumulation rather than retail mania.

The initial price surge cooled into a consolidation phase near the $0.00000948 level on Friday. Technical analysts view the current pause as healthy stabilization following the first major sector breakout of 2026.

Short-term indicators suggest the recovery remains constructive. The 10, 20, and 50-period moving averages turned upward this week.

Buyers are stepping in with conviction. Volume-weighted metrics point to sustained participation across major exchanges.

MACD reаdings remain positive. Oscillators are staying neutral. These metrics reflect an orderly consolidation rather than a state of exhaustion.

Shiba Inu Testing the Long-Term Trend Hurdle

SHIB continues to trade below its 100 and 200-period moving averages. Institutional desks use these metrics to define the longer-term trend direction.

The 200-day EMA has not yet faced a formal test in 2026. Reclaiming the 200-dаy EMA is critical for confirming a sustained trend reversal.

Related: Binance Founder Zhao Says Lack of Privacy Hampers Crypto Payments Growth

The current recovery remains constructive but lacks final confirmation from the higher timeframes.

Pivot points and moving averages show tightly clustered resistance near the $0.000010 mark. Price compression suggests the market is coiling for a larger move.

A clean breakout above the psychological “zero-eating” level likely brings stronger directional momentum. Analysts are monitoring lower timeframes for structure breaks to confirm if buyers are prepared to press their current advantage.

Accumulation Signals and Market Outlook

Recent post-rally behavior points to a market that has stopped falling. Early signs of accumulation are appearing on the ledger.

Momentum is improving and oscillators remain balanced. Clearing the long-term resistance at the 200-day EMA is the final requirement to turn this early strength into a confirmed bull trend.

Related: Kusama Reveals Details Of New AI Product in Recent Livestream

Traders are balancing this technical optimism against a cautious macro backdrop. The Fear & Greed Index remains near 28.

Broad retail sentiment has not yet reached a state of euphoria. The lack of retail mania suggests that seasoned participants are leading the current accumulation rather than speculative speculators.

This professional backing provides a more stable foundation for the next leg of the recovery.

Shiba Inu’s technicals are finally waking up, but don’t get blinded by the green candles. Short-term averages are pointing up, but the 200-day EMA is the “final boss” for this recovery.

Consolidation at these levels is actually a good sign. It proves that the 30% gains weren’t just a flash in the рan. The market is building a base.

If SHIB can turn the $0.00001 resistance into support, the “counter-trend” talk ends and the real bull run begins. For now, it’s a game of patience.