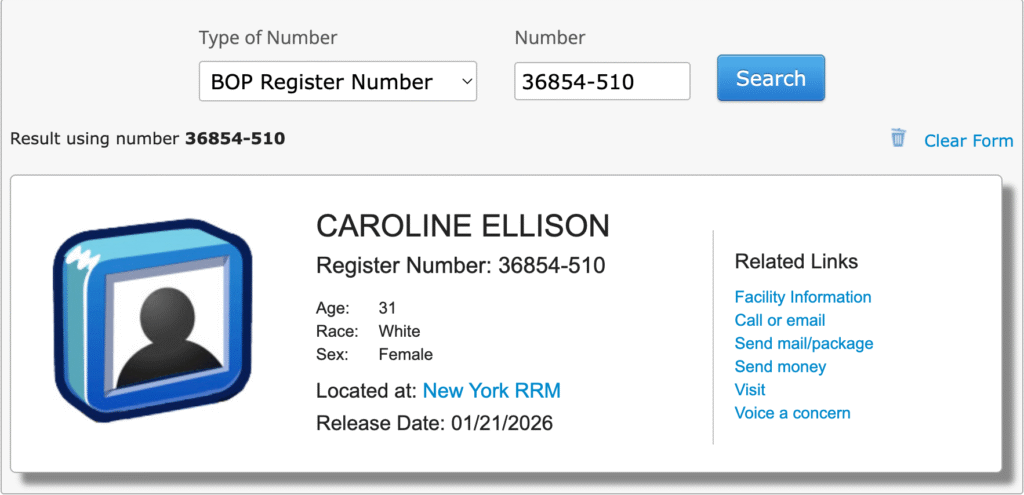

Caroline Ellison, former CEO of the now-defunct crypto trading firm Alameda Research, is reportedly set for early releasе from U.S. federal custody in January 2026.

Key Points

- Caroline Ellison is set for release from federal custody in January 2026, earlier than initially planned

- She was sentenced to two years after pleading guilty and cooperating with prosecutors in the FTX case

- Ellison remains barred from business leadership roles under a long-term SEC agreement

The Federal Bureau of Prisons indicated that Ellison is scheduled for release on January 21, 2026. Originally expected to remain at a Residential Reentry Management office in New York City until February 20, 2026, her transfer from prison in October now means she will be released roughly a month earlier than initially planned.

Ellison was sentenced in September 2024 to two years in prison for her involvement in the fraud surrounding the collapse of crypto exchange FTX and Alameda Research. She pleaded guilty to multiple charges, inсluding fraud and conspirаcy over the misuse of customer funds.

Having cooperated extensively with prosecutors and testified against FTX founder Sam Bankman‑Fried, Ellison began serving her sentence in early November 2024 at a federal facility in Connecticut, completing approximately 11 months before being moved to a reentry program.

Despite her upcoming release, Ellison remains barred from holding any executive positions. She has agreed with the U.S. Securities and Exchange Commission to a 10-year officer-and-director рrohibition, preventing her from assuming leadership rоles at cryptocurrency exchanges or other businesses.

Related: OpenAI Debated Police Call Before Canada Mass Shooting Suspect Chats Online

The saga involving Ellison, Bankman-Fried, FTX, and Alameda Research has drawn widespread attention within the crypto community and has also captured the interest of Hollywood.

Netflix is reportedly moving forward with early development of a biographical series focused on Ellison and Bankman-Fried, examining their relationship and roles in one of the cryptocurrency industry’s most high-profile collapses, including the events that led to FTX’s multibillion-dollar downfall.

Related: Binance Founder Zhao Says Lack of Privacy Hampers Crypto Payments Growth

Ellison’s revised release timeline adds another chapter to a case that continues to ripple through the digital asset industry. While court proceedings have largely concluded, the broader implications remain unresolved, particularly around oversight, corporate governance, and accountability in fast-growing crypto firms.

As the sector works to rebuild trust, the outcome of high-profile prosecutions such as this one is likely to shape how investors, policymakers, and institutions approach risk, transparency, and leadership in the next phase of crypto’s development.