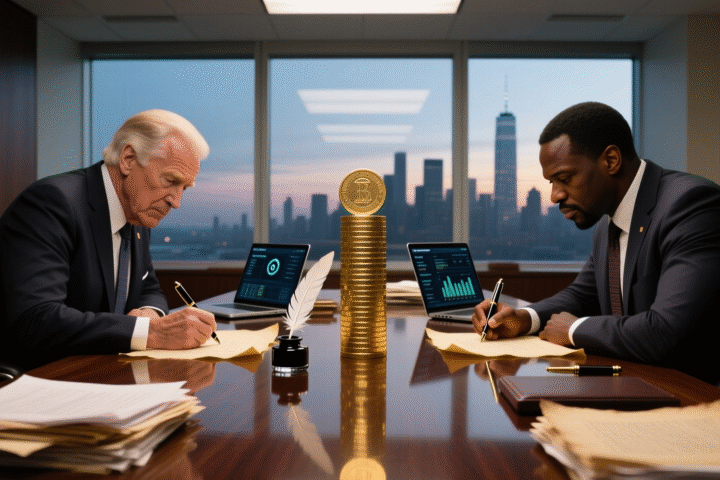

Timing your exit can be as crucial as choosing the right entry point in the crypto world. Former Goldman Sachs eхecutive Raoul Pal, now a prominent figure in the crypto space, shares valuable insights on when to sell your digital assets in a recent YouTube podcast.

Understanding the Basics of Trading Exit Strategies

An exit strategy refers to a trader’s plan on how and when to sell their holdings. It’s a roadmap designed to protect profits and minimize potential losses. Given the unpredictable nature of the crypto market, having a clear exit strategy helps traders remain objective, reducing the influence of emotions on trading decisions.

The Cyclical Nature of Crypto

Pal emphasizes that crypto markets are inherently cyclical. This observation stems from what he calls the “everything code” thesis. According to this theory, crypto cycles are influenced by global financial patterns, Bitcoin halvings, and U.S. presidential elections. Understanding these cycles is essential for making informed decisions.

Related: Hong Kong Proposes Rules Allowing Insurers to Invest in Crypto

Avoiding Market Timing Pitfalls

Pal cаndidly admits that attempting to time the market—whether buying or selling—is often suboptimal. Instead, he recommends a time-based approach. Rather than fixating on market tops, investors should focus on the long term. Pal suggests taking profits toward the end of the year, a period when crypto typically performs well.

Capitalizing on Market Downturns

Having cash ready during market downturns is crucial. Pal advises buying during lows, as these opportunities can lead to substantial gains. His recent strategy involved patiently waiting for what he believed was close to the market bottom. This approach allowed him to capitalize on significant rebounds.

The Psychological Aspect

Investing isn’t just about numbers; it’s also about emotions. Pal acknowledges the psychological hurdles investors facе, especially after a downturn. Reinvesting the same amount can be challenging due to fear of further losses. However, sticking with the long-term trend and ignoring short-term volatility is key to success.

Related: US Lawmakers Propose Tax Breaks for Small Stablecoin Payments and Staking

The Shib Magazine and The Shib Daily are the offiсial media and publications of the Shiba Inu cryptocurrency project. Readers are encouraged to conduct their own research and consult with a qualified financial adviser before making any investment decisions.